Business Insurance in and around Riverdale

Looking for protection for your business? Search no further than State Farm agent Celiann Ojeda de Young!

Insure your business, intentionally

Help Protect Your Business With State Farm.

Do you own an insurance agency, a barber shop or a lawn care service? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Looking for protection for your business? Search no further than State Farm agent Celiann Ojeda de Young!

Insure your business, intentionally

Cover Your Business Assets

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, surety and fidelity bonds or artisan and service contractors.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Celiann Ojeda de Young's team to learn about the options specifically available to you!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

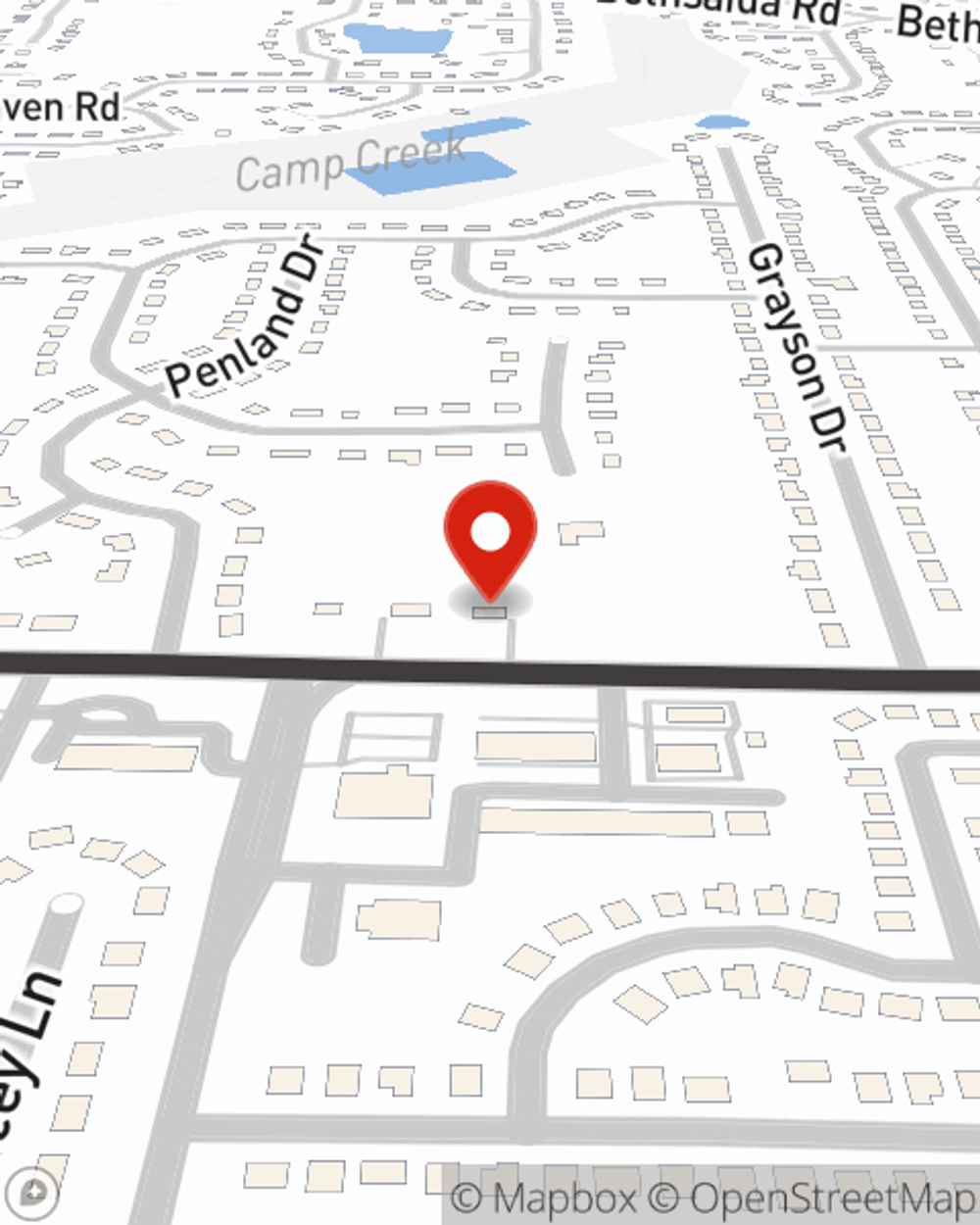

Celiann Ojeda de Young

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".